The death of the output deal

Sony signs a $7B+ global Pay-1 deal with Netflix. European Pay TV loses its premium window. Plus: Freely hits 1M and earnings season goes live.

Last call for the SME Breakfast Club.

If even 1% of your 2026 revenue depends on advertising, this is not the year to “wing it”.

On Jan 21, we’re doing a sharp, no fluff breakfast on what the ad market is really doing and what that means for streamers, broadcasters, platforms and publishers. Check out our line up:

→ Sarah Chinnery (née McKelvey), Little Dot Studios

→ Andy Jones, PubMatic

→ Ian Whittaker, Liberty Sky Advisors

→ Toby Hack, RTL AdAlliance

We’ll go straight to the questions on everyone's mind:

- What actually happened in 2025

- What that says about 2026 budgets and industry sentiment

- Where the ad glut is real and what still sells

- The CTV simplification everyone wants

And the room is already filling up with the people who will shape the conversations this year.

If you’re building hybrid revenue models, you want to be in that room.

🗓️ January 21st, 8.30am to 11am.

📍 Little Dot Studios, 91 Brick Ln, London.

🎟️ Register 👉🏻 https://luma.com/n3jlxtdp

📊 Live from earnings season

Earnings season is noisy, over-analysed, and often flattened into a couple of headlines that miss what actually matters. What we care about is reading between the lines, while the numbers, the language, and the strategy are still fresh.

So here’s our idea. You’ll still get our regular weekly episode of The Media Odyssey Podcast every Thursday. But on top of that, we’ll jump in with one-off, fast takes whenever major earnings calls hit. What’s structurally changing, what’s being quietly signalled, what’s real versus what’s narrative.

Next week is our first test with Netflix's earnings call. We both happen to be in London, so we’re going live sitting in the same room for once.

📍 Wednesday, January 21

⏰ 8am PST | 11am EST | 5pm London time

📺 Live on our YouTube channel

Come hang out with us, bring your questions, bring your hot takes. Let’s see if this format earns its keep.

🇪🇺 The pragmatism era

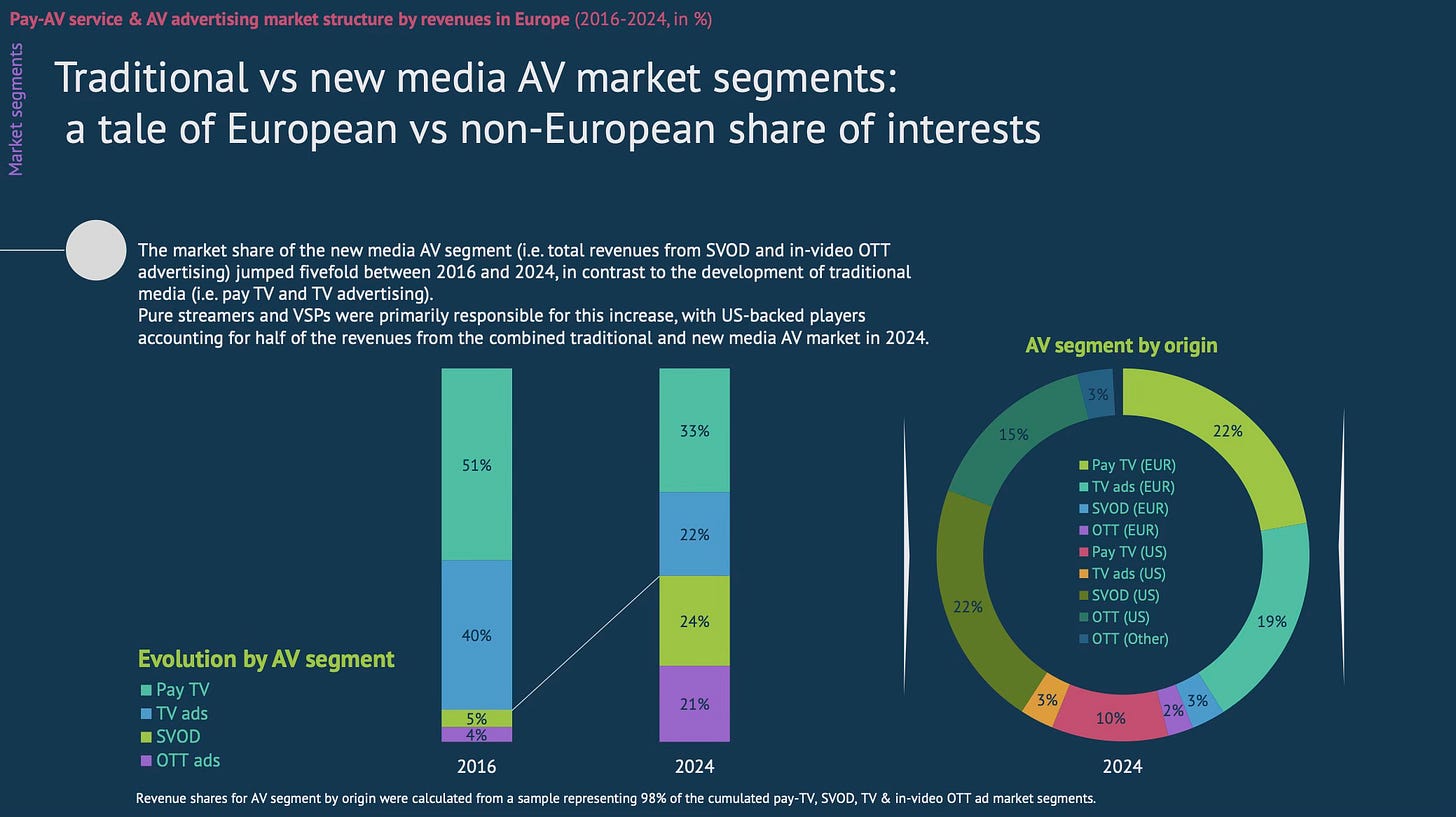

"European groups control traditional media, whilst US-backed groups dominate new media."

European Audiovisual Observatory | Observatoire européen de l’audiovisuel

As Europeans, that has to give you chills, right? Don't get me wrong, I'm not blind to this trend. But framed like that, I can't help but think we've missed the boat. We rule traditional media but it's not the direction of travel.

European audiovisual players can only apply a dual strategy now. One where they transform their legacy businesses while building their new media ones (with their own and operated platforms). One where they can only be pragmatic and make the deals so many criticise today: Netflix x TF1, France TV/M6/ITV/RTL/RTVE with Prime Video.

No matter how you look at it, there's no playing catch up anymore. It's all about making do with what we have.

Come tell me what you think in the comment section or hit reply.

Have time this week, dig deeper into the EAO’s latest report.

Evan Shapīro and I don't agree on the whole YouTube is TV debate but here's something we can both get behind: we want to know what you think about the pod.

Take the annual survey here and tell us who should we have on? What topics make you hit skip? Where do you actually listen? What would make this your favorite media podcast? Tell us. We're listening.

Thank you for being along for the ride ❤️

🇬🇧 Freely hits the million mark

Freely crossed one million weekly users over Christmas, doubling since September. That makes it the fastest growing TV platform in the UK in 2025.

The numbers tell a story of habit and transition (to an IP-only world): 55% of those users came back every day (over the festive period); over 2/3rd stream all their TV through IP.

The real test comes now. Can Freely convert that holiday spike into a year-round habit?

Read the full press release to know who’s dominated live viewing and on-demand top charts.

🇵🇹 85 days ‘til StreamTV Europe

The StreamTV Show is crossing the Atlantic for the 1st edition of StreamTV Europe on April 13-15 in Lisbon.

I’ll be there leading a pre-conference workshop on how to own the living room, practical strategies for 2026 and beyond. Three days covering content, advertising and technology plus the kind of hallway conversations you can’t find everywhere.

Register here. Who’s coming? Tell me in the comment section.

🇫🇷 The TV screen strikes back

Forget Duolingo, learn French listening to Emmanuel Crego (MD at Values.media), Jérôme Badie and myself discuss:

→ YouTube’s rise to prominence on TV screens;

→ The unprecedented alliances between TF1, France Télévisions and American platforms

→ The challenges of attention, monetisation and advertising

→ Sports as the last bastion... already weakened...

🎧 Listen here.

🎬 The death of the output model?

Netflix and Sony just signed a global Pay‑1 deal reportedly worth more than 7 billion dollars. Starting later this year and reaching full worldwide availability by 2029, Sony’s theatrical slate will stream exclusively on Netflix after cinema and home entertainment windows. Everywhere. Let that sink in.

For EU5 Pay TV, it’s a big one:

Sky had Sony’s first‑pay / Pay‑1‑style rights across the UK, Ireland, Germany, Italy, Austria and Switzerland under a 2020 “long‑term partnership” that extended Sky’s first pay window for Sony movies and bundled in franchises. That relationship was renewed in 2023 for the UK & Ireland, with Sky and Sony agreeing a “multi‑year extension of the first pay window” for Sony films on Sky Cinema and NOW.

In France, US studios effectively only have one meaningful buyer for that early premium movie window: Canal+. As the country’s primary financier of French cinema, Canal+ signed a new accord to invest around €480–503 million in French and European films over 2025–2027 in exchange for keeping a six‑month post‑theatrical window. To fill that window, Canal+ has struck distribution deals with Universal and Sony for new film releases and has publicly claimed to be the only French platform with content from all the US majors (which was true until its exclusive movie partnership with Disney ended when the pair didn’t agree on distribution terms).

Spain is the last classic output story. In July 2025, Movistar Plus+ and Sony renewed their multifaceted pact: Movistar Plus+ “will continue to be the exclusive Pay‑1 home in Spain for Sony Pictures feature films” after theatrical and home entertainment, and it keeps AXN / AXN Movies and a large Sony film and TV catalogue.

When those territory contracts expire, Netflix gets everything. The numbers explain why as Deadline reports rates jumped 40% compared to the previous deal, with the bulk of that increase coming from international. This is the independence play working exactly as Sony designed it. No streaming platform to feed means selling to whoever writes the biggest check. Right now, that is Netflix.

For European Pay TV, the question is now: what exclusive content remains? Sports rights are fragmenting; every streamer wants to keep its 1st window for its own and operated platform.

The premium movie window that once defined European Pay TV is migrating to streaming, deal by deal.

🗳️ Poll time

That’s it for today. Enjoy your weekend and see you on Tuesday for a Deep Dive edition of Streaming Made Easy Premium.