Six forces reshaping European Broadcasting

Funding crunch, partnerships, prominence and more, distilled ahead of IBC 2025

This is a reader-supported publication. If you like what I do, help me keep doing it by upgrading your subscription. This week, I’m making this Premium edition available to all subscribers to give you a taste of what Streaming Made Easy Premium has to offer. Enjoy today’s read!

“Working alone to challenge Big Tech, Netflix, and US studios seems untenable long term. It’s far more effective to turn competitors into partners.”

I don’t usually quote myself but as I was preparing for my annual State of European Broadcasting, I dug out my 2024 piece and imagine my excitement when I read its final sentence. Not that European broadcasters haven’t brokered deals or struck partnerships (with competitors) before but they’ve never done it to the extent they did this year. From Netflix x TF1, France Télévisions x Amazon to Disney+ with ITV, ZDF and Atresmedia, RTL x Sky, 2025 has been marked by the kind of high-profile partnerships I was preaching for.

These partnerships signal a mindset shift at broadcasters: they’re no longer afraid to find out what could happen once they’ve ventured outside of their own and operated platforms. For some in our industry, these deals are mistakes broadcasters will come to regret. For others (including yours truly), these are bold (and much needed) moves as broadcasters inevitably embrace their streaming era.

With +/- 45K Media & Entertainment executives about to converge to Amsterdam for IBC 2025, now is the time to explore the key trends, which I believe, will shape the European broadcasting landscape in 2025 and beyond.

Today at a glance:

Funding uncertainty

Consolidation to compete at scale

Partnerships to go faster

YouTube’s double-edged sword

Measurement’s hot mess

Prominence plays

Funding uncertainty

“Public broadcasting is broadcasting that is made, financed and controlled by the public, for the public. It is neither commercial nor state owned, free from political interference and pressure from commercial forces.”

The Public Media Alliance clarifies that counts as PSM is “any media, whether it is TV, radio or digital media”. Now for the purpose of this essay, any reference to PSM pertains to TV broadcasters (think the BBC, Arte, France Télévisions, RTVE, ARD and so on).

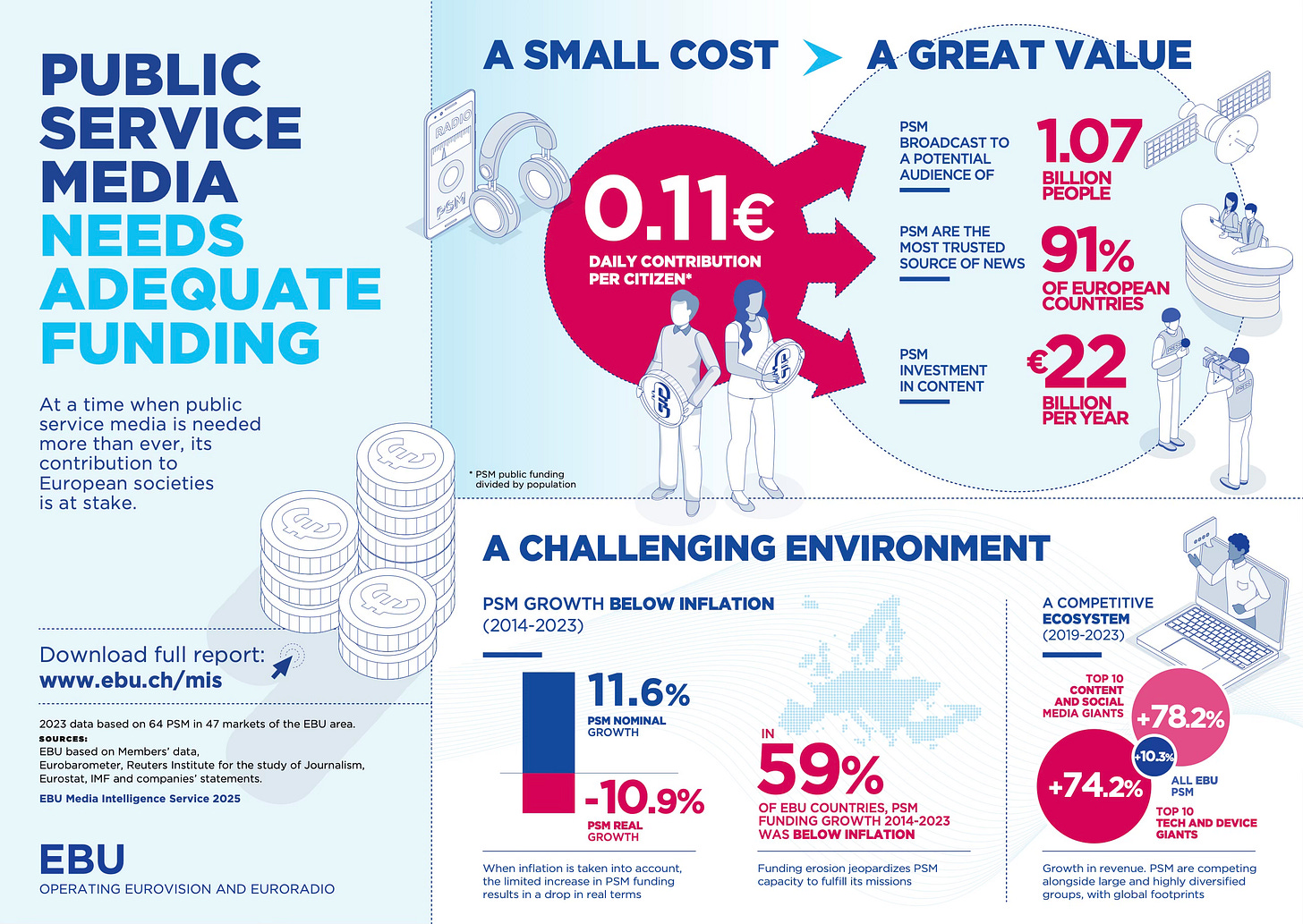

European public broadcasters are going through a funding crisis, at a time when we need them the most.

The European Broadcasting Union (EBU) released their latest PSM Funding Report (back in April 2025) and showed that 59% of their EBU countries saw a funding growth (between 2014 and 2023) below inflation.

France made permanent the VAT-based mechanism that replaced the licence fee in 2022, via an organic law adopted in late 2024.

Germany’s proposed increase of the Rundfunkbeitrag to €18.94 per month did not take effect on January 1st 2025. The current €18.36 holds pending legal and Länder decisions, which keeps ARD/ZDF planning on tighter budgets.

In the UK, the Royal Charter, governing the BBC, is up for renewal in two years’ time, and while the broadcaster’s ambitions are clear, the BBC’s ability to secure stable funding to deliver on these ambitions isn’t. The BBC is primarily funded by the licence fee (which rose by 6.6% in 2024 after staying flat since 2021 and sits at £169.50 rising to £174.50 from April). This year it expects that the CPI growth of the license fee will be partly offset by a 1% decline in the number of licence fee payers. In comparison, subscriptions services in the UK has increased by 30% on average between 2021 and 2025.

The BBC’s real-term funding has decreased by £1 billion per year compared to 2010, while production costs have risen significantly, particularly for high‑end content and sports rights. As global competition for creative talent and sports events ramped up, the same nominal budget could purchase less.

Their “Commercial arm is expected to deliver income growth in 25/26 despite challenges (…) and BritBox International is performing ahead of growth targets, (…) but reduced co-commissioning from global streamers has challenged the BBC’s ability to fill all funding gaps.”

It warns that without financial intervention, it may be “difficult to maintain current ambition and volume of UK content”.

Consolidation to compete at scale

As much as I love Europe and its structurally fragmented landscape, a lot of today’s business economics no longer work at single-country scale.

Almost two-thirds of all advertising spend in Europe is now digital (67.2%). Buyers concentrate budgets where buying is easy and cross-market. One broadcaster, one country, one stack cannot match that reach. At the same time, streamers now outspend commercial broadcasters on content in Europe’s big five. Ampere puts SVoD spend at roughly €10 billion in 2024, ahead of commercial broadcasters’ combined outlay. You will not win premium genres on price without more scale. Add sport inflation. The Bundesliga’s 2025–2029 domestic cycle totals €4.484 billion, about €1.121 billion per season, a 2% increase. You need a larger balance sheet and more windows to sweat those rights.

The market is already moving towards consolidation. RTL committed to buy Sky Deutschland for €150 million upfront plus up to €377 million in variable consideration. This blends free TV scale, a leading local streamer and premium sport under one roof with a two-year tech transition.

In parallel, MFE crossed 75% of ProSiebenSat.1 last week, unlocking control levers to build a pan-European (well across 3 countries for now: Italy, Spain and Germany), ad-funded platform.

On paper, consolidation is perfect: it brings scale, tech efficiencies, rights leverage, distribution power. Execution is the only proof that matters though and our industry has witnessed its fair share of botched mergers and acquisitions. Enter partnerships, a leaner and quicker way to unlock new business opportunities.

Partnerships to go faster

Consolidation takes years and a tolerance for integration pain. Partnerships take months and can have an instant impact on one’s business. In 2025, the best European broadcaster deals were signed to solve specific acquisition, distribution and monetisation challenges:

→ Acquisition: Rights inflation pushes you to be even more strategic. Mediaset’s sublicense from DAZN for the Club World Cup spread risk, reach and ad money in a soft pay-TV environment. DAZN streamed every match for free. Mediaset took one match per day on free-to-air with Publitalia ’80 selling the spots. That is not diluting value. That is turning a single expensive asset into multiple sellable products across different buyers and dayparts. You keep halo effects on your free channels. You let the sports streamer carry the long tail. Everyone sells what they are best at.

→ Distribution: Broadcasters’ programs have always travelled outside of their own and operated channels and platforms (through licensing deals, coproductions). What changed this year? They’re launching branded content hubs inside streamers.

TF1 & Netflix surprised the industry with their partnership announcement during this year’s Cannes Lions. This deal is a worldwide first. Netflix has never integrated broadcast TV channels, nor a catalog of that size (e.g. 30K hours of content live inside TF1+) before. At best, they included a partner logo on program assets to give attribution to UK broadcasters.

France Télévisions made a similar move with Prime Video in July, planting a france.tv hub with live, previews and replays on the Prime home screen.

Both moves open new distribution routes. French viewers already open Netflix & Prime Video every night. Broadcasters have chosen to meet them there to maximise their reach.

Disney + signed with ITV to launch “Taste of Disney+” & “Taste of ITVX”, with ZDF Studios for a “ZDF Films and Series” hub. Atresmedia will see 300 hours of its programming go to Disney+ in Spain but more interestingly Atresmedia’s new series “Mar Afuera” will premiere on both Atresmedia & Disney+ on Sept. 14th.

“This deal also reflects our broader commitment to supporting local broadcasters across Europe including our recent collaboration in the UK with ITVX and ZDF in Germany. We’re focused on bringing the very best, local stories to our customers, alongside our extraordinary slate of original Disney+ series such as recent hit Ladrones: la tiara de Santa Agueda and global hit movies and shows like Lilo & Stitch and FX’s The Bear.“

Karl Holmes - SVP D2C & GM EMEA Disney+

→ Monetisation: In the UK, Sky, ITV and Channel 4 announced a joint self-serve premium video marketplace, using Comcast Advertising tech, to let SMEs buy broadcaster inventory across all three portfolios from 2026. This is a direct play for the long tail that spends inside Google and Meta.

In DACH, RTL Deutschland and ProSiebenSat.1 deepened their “Ad-tech made in Europe” cooperation, linking Smartclip and Virtual Minds and moving toward programmatic linear activation inside RLT Ad Alliance.

ProSiebenSat.1 also teamed with FreeWheel to enable pan-European cross-media campaigns.

These are not press-release partnerships. They change buying ergonomics, which is where budgets move. They also build an alternative to US only ad-tech stacks.

We’ve kicked off Season 2 of The Media Odyssey Podcast with Evan Shapiro.

What should you expect this season? Our usual banter, our hot takes on industry news and a bunch of guests who are pushing the boundaries of the Media and Entertainment with new mindsets and playbooks.

YouTube’s double-edged sword

Partnerships also help reach audiences broadcasters struggle to win at scale inside their own apps pushing them to venture on platforms like YouTube.

The move is not an easy one. On one hand, YouTube offers massive reach and direct engagement with audiences; on the other, there’s a deep fear that releasing content on YouTube will cannibalise own and operated platforms, muddle brand and content attribution, accelerate audiences’ shift away from Linear TV and altogether diminish advertising revenue.

Regardless of where you sit on the “YouTube is or isn’t TV” debate, I don’t see how you can argue broadcasters should stay away from YouTube (or limit their presences to trailers and promos). YouTube is definitely not just another UGC video platform viewers play around to kill time. 1B hours of YouTube content is watched on TVs daily; 80% of fans (online 14-44 year-olds who identify as fans) use YouTube to consume content about the person or thing they’re a fan of at least weekly and 66% of Gen Z Americans agree that they often spend more time watching content that discusses or unpacks something than the thing itself.

On The Media Odyssey Podcast, we went digging and spoke to executives at broadcasters to understand their YouTube strategies:

Channel 4 spoke about how they position YouTube as an extension of their overall content ecosystem, rather than the evil platform one should stay clear of.

CBC shared insights and data on how they tested, adapted and expanded their YouTube presence, the challenges faced and the data-driven results they got.

BBC Studios, the commercial arm of the BBC, detailed for us their 4-pillar fandom strategy and how to pull a 110 % revenue growth once you start selling your own inventory.

« Don't succumb to YouTube like you did with Netflix”. This is one of the comments we've received after the release of our Channel 4 episode. The argument being that you're making a buck now but they will eat you later. What's the alternative though? Keeping everything to yourself hoping viewers will only watch your content on your own and operated platforms? You don't get to choose. Viewers do and they wanna watch content on your platform, on Netflix, YouTube and others.

If the legacy broadcast model assumes that YouTube and social should always funnel back to the broadcaster app, the 2025 model should accept that some lines now run the other way and that is fine if you program it deliberately.

Measurement’s hot mess

“Measurement is a hot mess”. It's not from me, it's from Jenny Bullis, CEO of Dentsu Media’s UK and Ireland, at the Media Research Conference in December 2024.

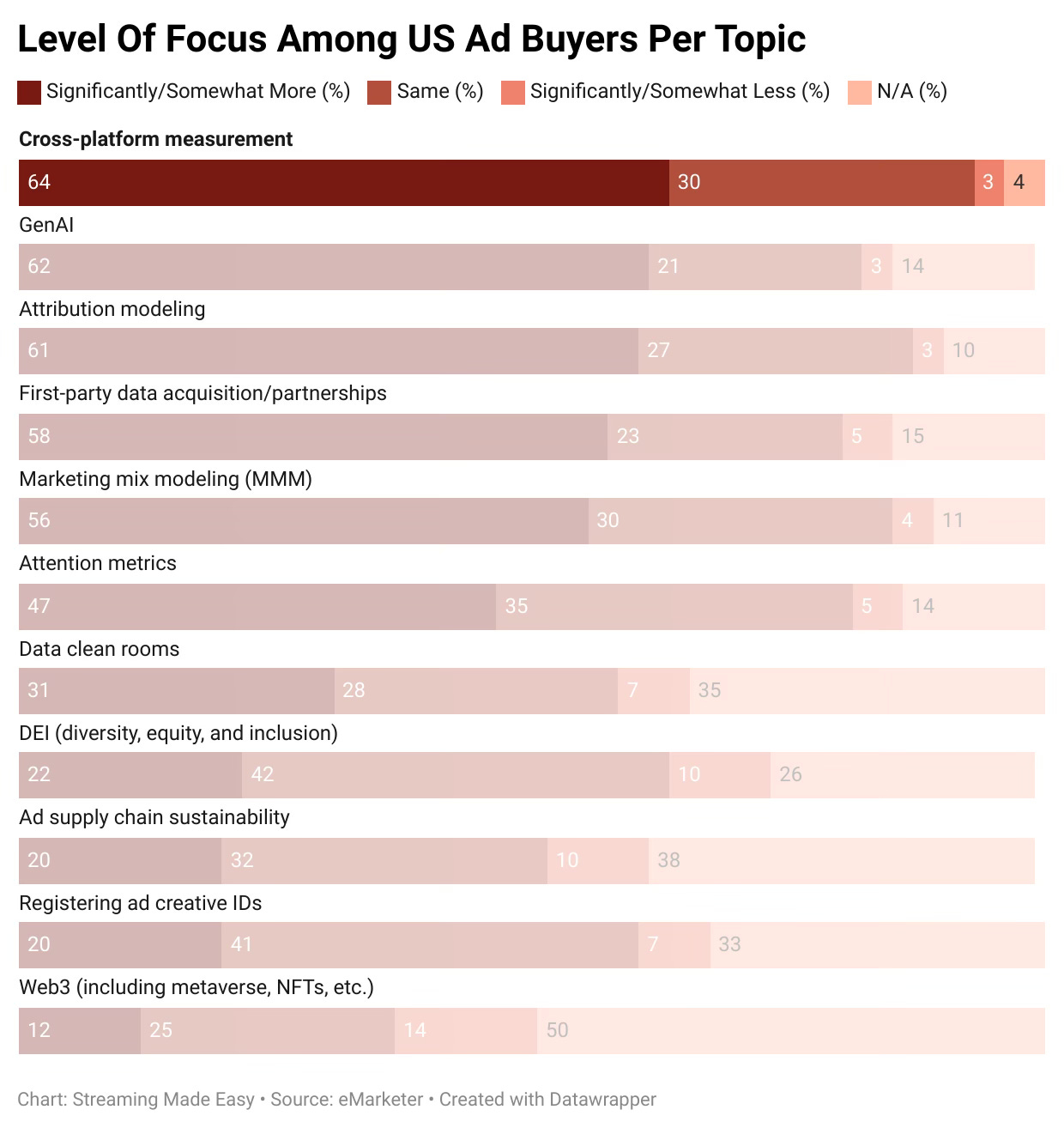

According to eMarketer, 64% of U.S. ad buyers say cross-platform measurement is their number-one priority looking toward 2025 and let’s be honest, the same challenges plague just about every market around the world. As advertisers try to make sense of an ever-expanding universe of pay TV, broadcast, streaming, and digital platforms, the need for consistent, comparable data has never been more pressing.

Buyers do not want a philosophy of “total video.” They want one planning curve, one post-campaign read and a clean story on duplication and outcomes.

The pieces are finally snapping into place:

In France, Médiamétrie selected AudienceProject’s technology to accelerate a cross-media video advertising measurement solution that spans on-demand ecosystems and linear TV.

In Germany, AGF launched a six-month proof-of-concept to integrate return-path data with the TV panel. That pushes Germany toward a hybrid currency that recognises platform-level realities without abandoning panel discipline.

In the UK, BARB appointed RSMB to build a single interface that unifies its pre-campaign Advanced Campaign Hub with CFlight post-campaign evaluation. This matters because it shortens the distance between plan and proof and reduces the operational pain of stitching systems. BARB also began reporting TV-set viewing to 200 YouTube channels as part of its official outputs, a world-first move for a TV joint-industry committee.

At European level, a number of European joint industry committees (JICs), media owner committees (MOCs) and research companies created the AMC (Audience Measurement Coalition) to collaborate on pan-European audience measurement standards and to serve as a voice to European regulators on policy matters.

None of these projects are perfect. Together they point in one direction: panel plus census is becoming the normal way to trade moving image, no longer an experiment.

Prominence plays

Choice fatigue has become the norm. Now that broadcasters have gone ubiquitous, they should tackle their next biggest challenge: discoverability. There’s being available and being seen on a platform.

How discovery went off the rails:

→ Multiplication of entry points to access catalogues: Non exclusive licensing means a single program can live on four different services.

→ Shallow tagging: Genre + release year no longer cuts it. Today’s recommendation engines need mood, theme, dialect and moment metadata to make sense of a title.

→ Engagement‑first algorithms: If you liked “Downtown Abbey” once, your home screen fills with genteel period dramas and stately manor intrigue. Great for short‑term watch hours, terrible for widening horizons.

→ UX and UI have grown dull: Endless rows of near-identical rail of themed sections and thumbnails.

→ Last but not least, the CTV playbook turned every touch point into a pay to play opportunity. Home screen banners, app and program rails, remote buttons, are all up for grabs.

Broadcasters’ deals include negotiated app placement, a level of marketing support but to be top of mind week in week out (and win that 1st click), they now have to invest on platform marketing dollars.

Regulators have started to take notice of the growing importance of CTV platforms in our media habits:

Germany paved the way by creating a public value label to ensure the prominence of a number of German services on CTV platforms. The result? A subpar experience with a “Public value” corner where 230 services were dumped into.

The French legislator created a “General Interest Service” status. This status is given to a set of audio & video offerings which fulfil a public service mission (public entities France Télévisions, Arte etc.), contribute to the diversity of opinions, fund and distribute local content creation (commercial Free to Air stakeholders). The jury’s still out on the actual implementation.

As part of the UK Media Act 2024, Ofcom has published the list of the Television Selection Services (TSS) or connected TV platforms that will be designated by the Secretary of State to be required to ensure that BBC iPlayer and other public service broadcaster TV players will be given due prominence. Once designated, a platform must make your PSB player available, prominent and easy to access, and Ofcom will judge whether the implementation meets the law’s test rather than a platform’s interpretation of it.

Gone are the days where CTV platforms could freely run their UI. How an app, a tile is positioned is the byproduct of the UI / UX look and feel, the deals struck between Smart TV and apps and now regulation.

No matter what headwinds European broadcasters face, they still own assets competitors cannot clone. When they lean into what they do best, telling local stories, staging live that brings a country together, building locally relevant products, and fostering fandom, attention and spend follow. They do not need to mimic global streamers, nor YouTube. They need to make their strengths travel across every surface of that TV screen. Do that and the streaming era looks less like surrender and more like maturity, a market where European stories remain easy to find and worth enjoying.

That’s it for today but before you go: a comment, a like or a share come a long way 🫶

Enjoy your week and see you on Thursday for another edition of Streaming Made Easy!