RTL + Sky: Meet Germany's New #3

My take on another groundbreaking deal in Europe

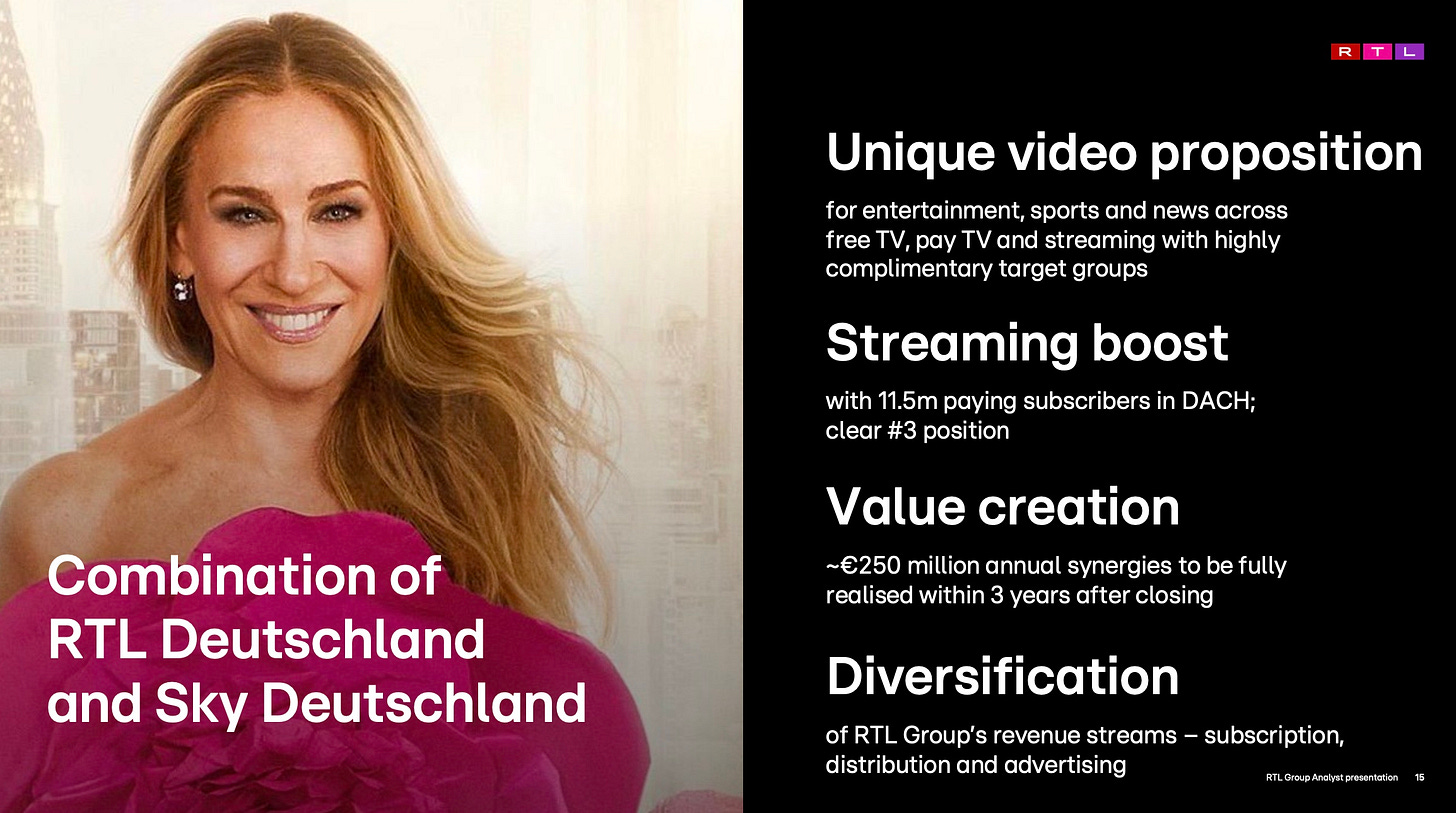

RTL Deutschland, the ad-funded mass-market colossus, is buying Sky Deutschland, the premium pay-TV fortress. You couldn’t have drawn up a starker contrast if you tried. Yet the pair has more in common than you think.

For 150M€ plus a performance kicker (of 377M€), RTL gets Sky’s Bundesliga, Premier League, Formula 1, prestige series and a brand people associate with “worth paying for”. That’s the short version. The long version is a knot of brands, tech stacks and subscriptions which could weave into a market-defining local powerhouse if executed well.

Today at a glance:

Opposites Attract

Why They Fit

Where It Could Be Tricky

Outstanding Questions

What Happens Next?

Opposites Attract

RTL: Mainstream Appeal, Massive Reach

RTL’s free to air business is simple: broadcast widely, attract eyeballs and sell ads. It doesn’t stop here though as RTL is one of the few European broadcasters who has managed to build a subscription business on top of its broadcast one.

Its portfolio includes:

12 channels from RTL itself to Vox or NTV (4 of which are Pay TV channels: RTL Crime, RTL Living, RTL Passion and Geo Television).

In 2024, the combined average audience share of RTL Deutschland in the target group of viewers aged 14 to 59 was 26.3% (27.4% in 2023). A 6.3% lead over its main commercial competitor ProSiebenSat1.

With its portfolio of 8 FTA channels and 4 Pay TV channels, RTL reached 25M viewers every day in 2024 (26.5M in 2023) according to AGF.

NB: AGF changed its methodology in January 2024 to include the following new metrics: Households that do not have a TV set and watch content via tablets, smartphones or laptops are now included in the measurement, alongside the live stream of linear TV programmes across all device. Hence we’re not comparing apples to apples when we look at 2023 vs 2024.

RTL+, Germany’s largest local streamer with 6.2M paying subscribers (in Q1 2025) plus an ad-supported free tier (the group doesn’t share details on the monthly active users to such tier). Worth noting that RTL+ is growing faster than the overall SVOD market in Germany.

A multi-vertical offering spanning from TV, video, music, podcasts to concert / live event tickets, audiobooks and magazines.

A huge advertising clout, backed by deep connections to retail, automotive, finance and consumer brands, via RTL Ad Alliance who bundles TV, streaming, radio and even digital inventory under one roof.

Content factories across drama, reality TV and news.

In 2024, RTL Group as a whole invested around €4 billion on content, combining its broadcaster programming budgets and Fremantle’s productions.

RTL Group additionally disclosed that it plans to increase annual content spend for its streaming services (including RTL+ in Germany) to around €500 million per year by 2026.

RTL thrives on scale and frequency. Its strength lies in putting shows everywhere Germans look whether on TV screens or their daily commute.

Sky: Exclusive, Pricey

Sky plays a different game. Its appeal is exclusivity, scarcity and prestige: