It hasn’t just been a wild few weeks. It’s the start of a new cycle for Europe media, one where distribution, ownership and prominence are being renegotiated in real time. Let’s get into it.

🚫DAZN: No Signal

on Your Operator TV.

DAZN paid €90M per year for exclusive rights to the Jupiler Pro League (2025–2030), but as the season kicks off, Belgian fans won’t find football on Proximus, Orange/VOO, or Telenet.

Citing insufficient carriage fees, DAZN has pulled the plug on operator negotiations meaning matches will stream exclusively on the DAZN app, at least for now.

The question is: who blinks first? Will the telcos cave and pay up to keep football in their bundle? Will pressure from fans push DAZN and the league stakeholders back to the table to renegotiate the rights package?

Either way, it’s another football example where the numbers just don’t add up. Sports rights are sold at prices that leave buyers and resellers with no clear path to profitability unless someone, somewhere, overpays.

🇪🇺 Deals, Deals, Deals

After TF1 x Netflix, RTL x Sky, France Télévisions x Amazon, here comes:

🔁 RTL Zwei + Warner Bros. Discovery merging ad sales into one joint venture taking on the inventory of DMAX, Tele 5, Discovery Channel and setting the stage for HBO Max’s 2026 German debut (?!). What a weird name for a JV though…

📈 Dyn Media just added Schwarz Group (yes, Lidl) and DFL as shareholders. Now backed by grocery power and Bundesliga muscle, they’re scaling their sports streamer with 3,000+ live matches and expansion plans abroad. Sky and DAZN must be fuming…

🌐 Deltatre is acquiring Endeavor Streaming merging tech stacks under one global OTT services umbrella. Clients? NFL, NBA, WWE, UEFA, LIV Golf… you name it.

2025 isn’t just the year of collaboration, it’s the opening act of a new decade for European media.

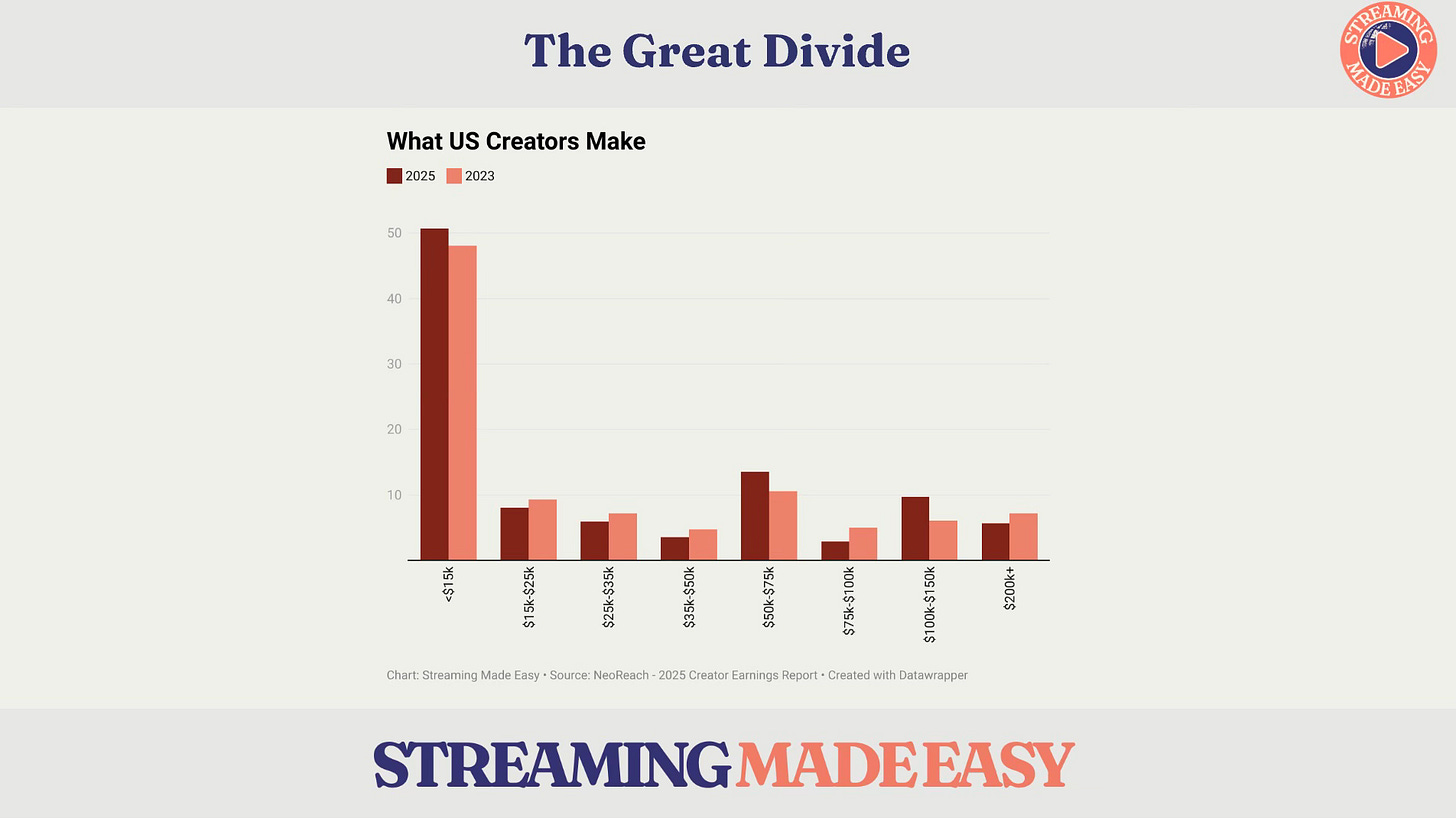

💸 The $250B Creator Economy…

Where half of the US creators earn <$15K.

NeoReach’s 2025 Creator Earnings Report is in.

The headline? 57% of US full-time creators still earn below the U.S. living wage ($44K/year). Even more striking: over 50% earn under $15K annually. A threshold the report calls the Monetisation Barrier.

The difference between the 50% stuck below $15K and those who break through?

→ They go all-in on video

→ They have a unique voice

→ They test and learn non stop

→ They own their brand or product

→ They run their content like a business

Most-used platform? Highest average earnings? Grab the report to find out.

💪🏻 Dhar Mann’s Creator Blueprint

Speaking of creators, this week on The Media Odyssey Podcast, Evan Shapīro and I were lucky to speak to a creator who broke through big time: Dhar Mann.

“What I used to be ashamed about (my struggles) actually became my superpowers.”

Dhar Mann gets real about building one of the world’s biggest scripted content empires starting from a place of personal collapse, not confidence. This isn’t just an origin story. It’s a masterclass on modern media entrepreneurship: messy, human and laser focused.

LISTEN and/or WATCH in full: APPLE PODCASTS | SPOTIFY | YOUTUBE

🎁 That’s A Bundle

What do Shudder + HelloFresh, Calm + UFC, and ChatGPT + Tinder Gold have in common?

They’re viable cross-category bundles in an economy that’s shifting from siloed subscriptions to personalised stacks.

Giles Tongue, VP of Marketing at Bango, put it best:

“Today’s subscribers are bundling meditation apps with heavy-metal playlists and using AI to perfect their Tinder icebreakers. These quirky combos represent the next stage in the bundle economy.”

With 114 connected providers, Bango’s Digital Vending Machine® can power over 2 billion bundle combinations.

Do consumers want in? Find out here.

🇧🇪Flanders Is Taking Back The Remote

More regulation coming to your Smart TV. Germany, France and now Belgium's Flanders region.

Flemish Media Minister mandated pre-installed local apps on all smart TVs and car dashboards by July 2026. The pattern in Europe:

→ Germany: 230 services in a dedicated "Public Media" corner

→ France: "General Interest Service" status for prominence

→ Flanders: Pre-installation required for VRT Max, VTM Go, GoPlay, Streamz

App placement used to be commercial. Now it's in part political. No more hoping users will search for local apps. Every market wants the same thing: cultural sovereignty on the home screen. Smart TV platforms can fight it or embrace it but they can't stop it.

That’s it for today but before you go:

🗳️ Poll Time

Enjoy your day and see you on Tuesday for a Deep Dive edition of Streaming Made Easy Premium.