My 2025 Predictions: The Mbappé Report Card

Which predictions landed and which ones fell flat? I graded all 15 with Mbappé flair.

It’s Premium subscribers who make this level of reporting, research and analysis possible. Become one of them today ❤️

Have you heard of the Argentinian teacher who grades her students with pictures of Messi?

Today in Streaming Made Easy, I’ll grade my 15 predictions for 2025 the same way but trading Messi for Mbappé of course. Let’s go!

YouTube definitely became bigger and more relevant than ever this year, though it never quite hit the 15% market share on the Nielsen Gauge. However, in February 2025, YouTube reached 11.6% of total TV viewing, marking its “best monthly share to date,” and by July, that number reached 13.4%. As of October 2025, YouTube holds 12.9% of total US television viewing on the Nielsen Gauge.

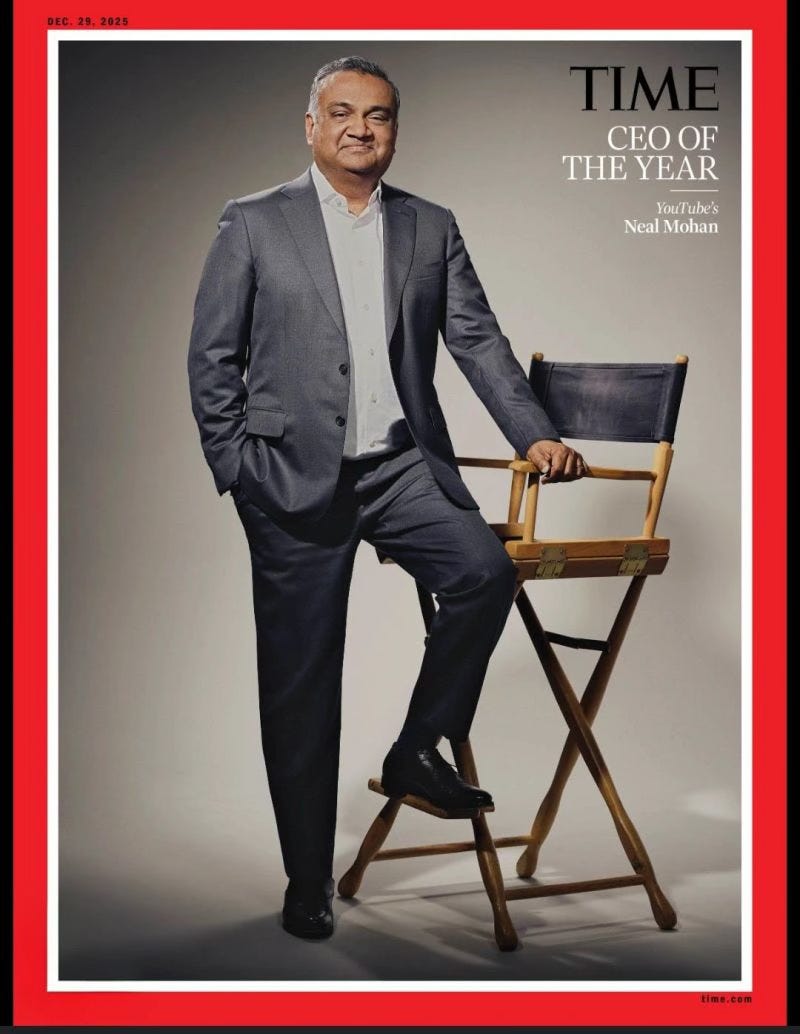

Beyond the Gauge, for the first time ever, YouTube was a host at MIPCOM 2025 with a full program track on formats and monetisation. The debate about whether YouTube is TV has been raging and regardless of where you stand on this, 2025 was the year of YouTube and it’s no surprise to see Neal Mohan named CEO of the year by Time.

As for adding new premium features for channels transitioning from ad-only to hybrid models, YouTube expanded its Partner Program to include YouTube Shopping, Channel Memberships, YouTube BrandConnect to support branded content campaigns, and recently the YouTube Activation Partners program which connects advertisers with specialised agencies.

For more of a deep dive into YouTube read here or if you want to read how broadcasters are successfully using YouTube, check out our articles on: BBC, TF1, M6 and France TV.

Grade: A

European telcos and Pay TV groups have started to (reluctantly) embrace CTV and launched native apps, dealt pre-installed status or dedicated remote buttons to be present on TV sets without systematically forcing proprietary hardware on customers.

Canal+ and Samsung extended their partnership to cover over 40 territories globally. This new extended partnership includes the distribution of Canal+ applications on over 25 million Samsung Smart TVs. Canal+ applications will be preinstalled on the home screen of newly sold Samsung TVs from 2024 and 2025.

Deutsche Telekom went even further with Vidaa by becoming the 1st Telco to be the default OS of a third-party device. Come 2026, Hisense TV buyers will be presented two options at set up: the Vidaa OS or the Magenta OS.

In Italy, Titan OS announced new TIMVision availability across Titan-OS powered Philips Smart TVs, again highlighting how European pay TV is leaning into CTV.

And of course, Free launched the 1st truly OTT offer on the French market. Starting at 0.99€ per month, you can become a Free subscriber with no obligation to take up a subscription that includes their STB.

Grade: A

Starting in July 2026, Netflix subscribers in France will gain instant access to TF1’s five linear channels and dive into roughly 30,000 hours of TF1+ on-demand programs. The TF1–Netflix deal shows Netflix is indeed exploring becoming more of a “hub” for traditional TV content and is likely an early indicator of reinvention beyond “just more originals.”

The move to go after WBD fits the bill of being bolder (and hungrier) but we’re yet to see 1/ if this deal actually happens, 2/ if it fuels Netflix’s growth or becomes a financial liability.

As for sports, Netflix now plays ball (e.g. with a Champions' League' bid) but nothing has panned out so far. When it comes to bringing podcasts and YouTube talents on, Netflix is playing catch up, not innovating if you ask me.

The earliest signs of this prediction are emerging as Netflix is clearly experimenting with becoming a bigger television hub. But it’s too early to say whether this becomes a new operating model for the Los Gatos firm.

Grade: B