My 10 bets for Media and Entertainment in 2026

10 bets, no safe calls: CEO handoffs, ad pain, corporate creators, discovery via LLMs, social to CTV, microdrama, M&A, and more.

Happy new year everyone! Welcome to the 1st edition of Streaming Made Easy 2026 💥 I’m pumped and ready for another year with you all. I have big plans for SME this year.

But let’s kick off with our new year’s tradition. Every January, I stare at my notes from the past twelve months and ask myself: what mattered and what comes next? Here are my 10 bets on where Media and Entertainment is headed. Some of these may fall flat or age poorly. That is the price of putting stakes in the ground. But if you have been reading my work, you know I would rather be wrong and interesting than right and boring. Let’s go.

#1. The rise of the Corporate Creator skillset

The creator economy more than doubled from 2021 to 2024. According to the IAB’s 2025 Creator Economy Report, creator economy ad spend climbed 26% in 2025 to hit $37 billion in the US alone. That growth rate is nearly 4x faster than the overall media industry. Marketing Dive confirmed that nearly half of marketers now cite creator content as a “must have.”

In 2026, more companies will start thinking like creators and this time around not as a marketing gimmick or as a checklist, but as core business strategy and to do that, they need a new kind of staff. This is your cue (to learn new skills, reinvent yourself, be bold), don’t waste it.

#2. Podcasts on Netflix will be a total bust

Netflix wants what YouTube has: affordable, repeatable, studio-style podcasts with live episodes and clippable moments. The streamer struck deals with Spotify & The Ringer Podcast network, Barstool Sports for shows like Pardon My Take, with iHeartMedia for The Breakfast Club and My Favorite Murder.

The problem? Everything about how people actually watch Netflix and consume podcasts.

43% of US TV watchers say they binge-watch more than 3 episodes of a show at a time according to GWI. Podcasts are a weekly format. They are meant to drip, not drop all at once. Creators moving from YouTube to Netflix also lose the comment sections, community features and algorithm they have spent years learning which will hurt their growth mid-term.

My bet: Netflix will try this, struggle to gain traction and quietly scale back within 18 months.

#3. A new age of discovery in the era of GEO and LLMs

Discovery failure is now a critical churn risk. According Gracenote’s new 2025 State of Play report, viewers spend an average of 14 minutes searching for something to watch. In France, that stretches to 26 minutes. Nearly one in five users will abandon a viewing session if they cannot find content quickly. For 18 to 24 year olds, it jumps to 29% and 49% of viewers say they would cancel a service if discovery is too time consuming.

The industry is already responding. According to Adobe Business, 56% of media and entertainment companies deliver personalised content recommendations on their platforms and 57% generate personalised ad copy for audience segments.

But discovery is not just a retention play, it is becoming an acquisition channel. Similarweb’s 2025 Generative AI report found that AI platforms generated over 1.1 billion referral visits in June 2025, up 357% year over year. Consumers now start their journeys inside AI assistants, asking questions and shaping preferences before they ever reach a streaming app. A recent Adobe Express survey reports that 77% of Americans who use ChatGPT treat it as a search engine, with 24% choosing it before Google. The next generation of viewers may never type “what should I watch” into Netflix or others. They will ask ChatGPT, Perplexity or Gemini and go wherever the answer sends them.

Streamers must design their GEO (Generative Engine Optimization) strategy now. The new must have App Store may be nested in ChatGPT and its peers.

Get to shape Streaming Made Easy in 2026. How? By filling out the survey form below. It will take you 4 minutes tops! Go to the Annual Survey or pull up your phone and scan the QR Code below. Respondents can enter the raffle to win one of the 5 annual subscriptions to SME Premium.

#4. Streamers go experiential

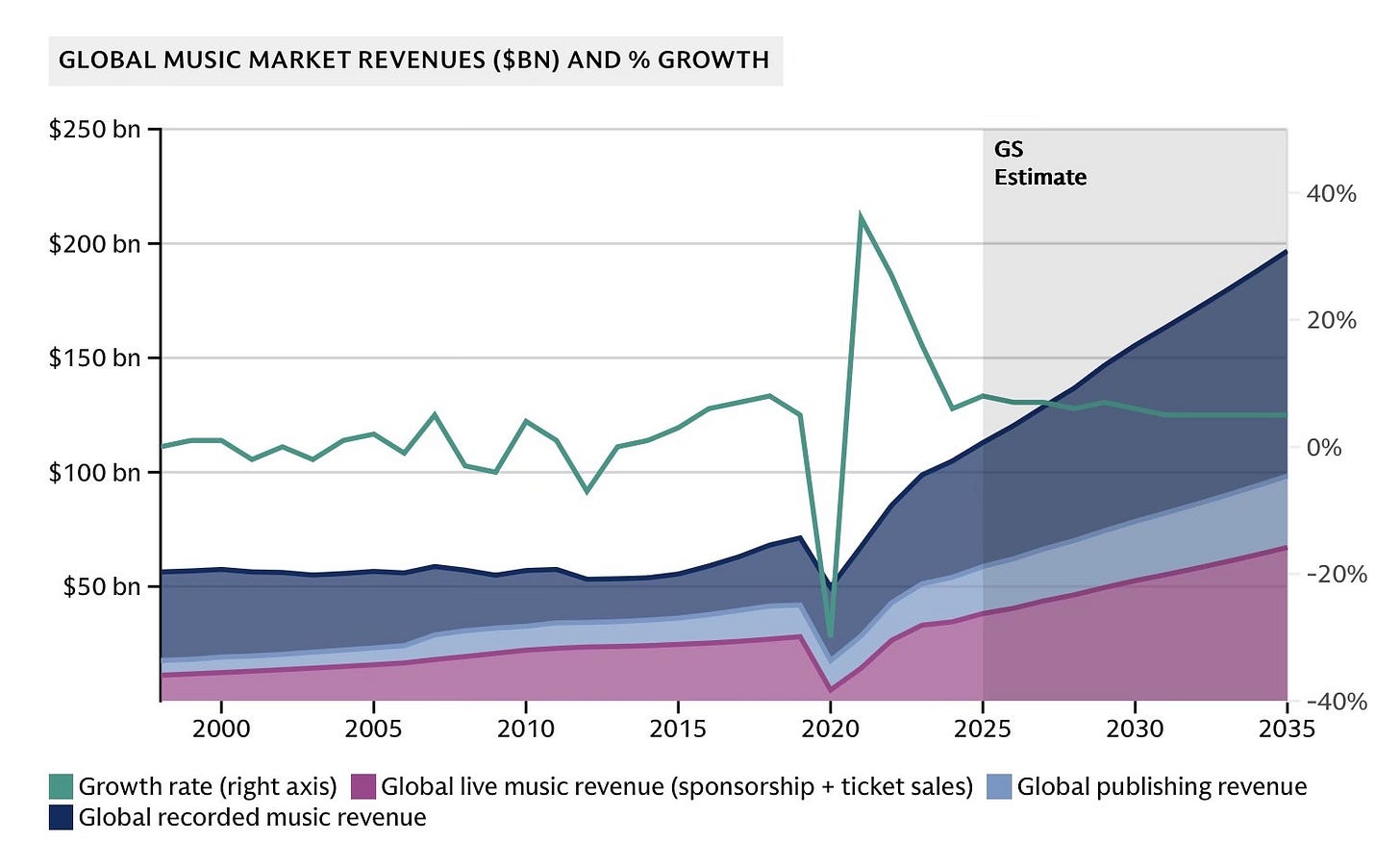

Goldman Sachs forecasts global music revenues will nearly double to $200 billion by 2035, with live music expected to grow at a 7% CAGR. Live music revenues are projected to grow from $34.6 billion in 2024 to $67.1 billion in 2035.

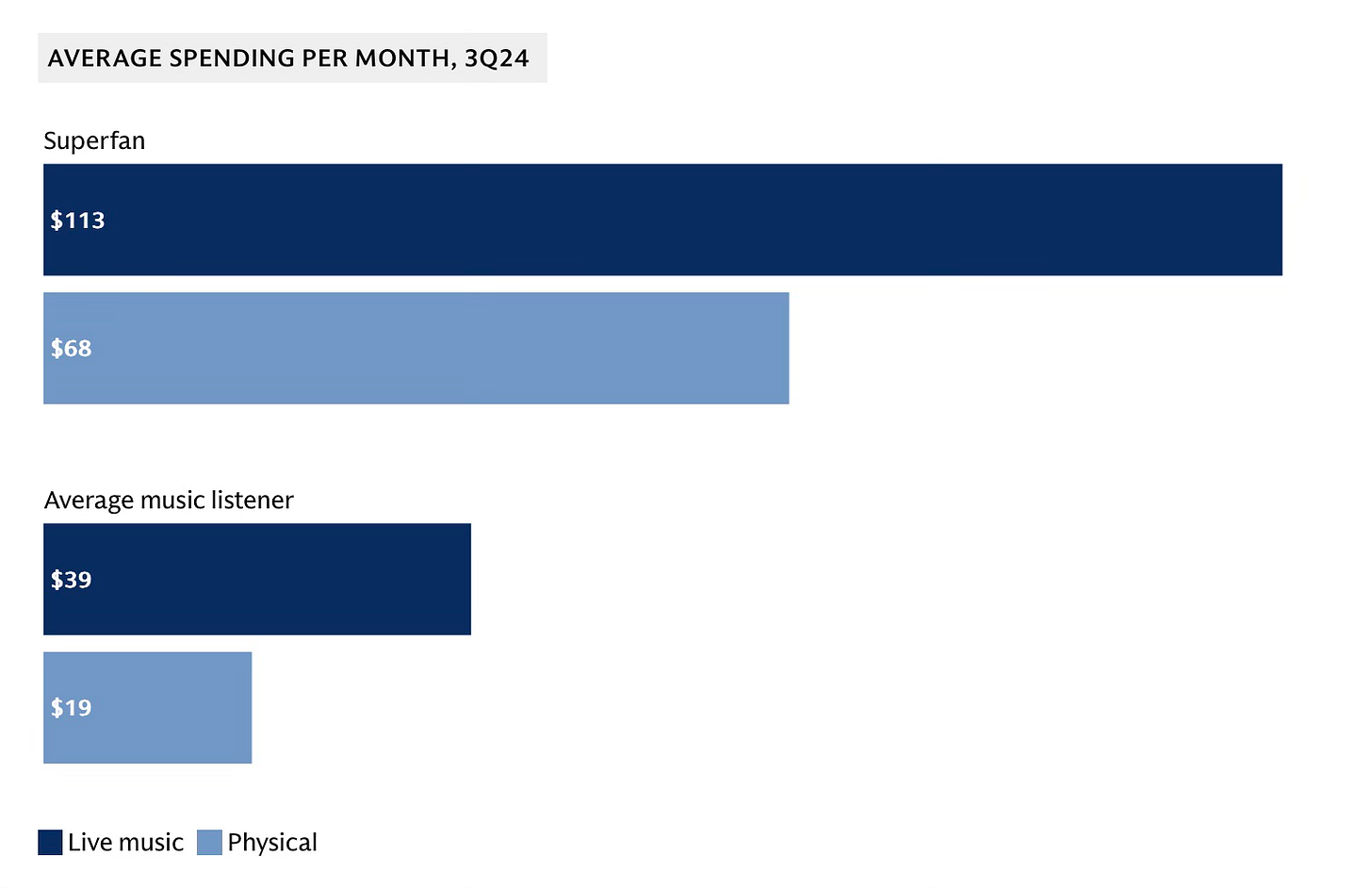

Live builds connection, it feels human. In an era of AI-generated content flooding every platform, that authenticity becomes a valuable premium asset especially if you tap into super fans.

If streamers want to thrive, they need to tap into live and experiential somehow. That could mean concerts, live sports watch parties, interactive premieres or entirely new formats we have not seen yet. The streamers who treat themselves as content libraries will lose to the ones who build communities around shared moments. MrBeast is already two steps ahead of everyone else.

#5. Social Media apps flock to CTV

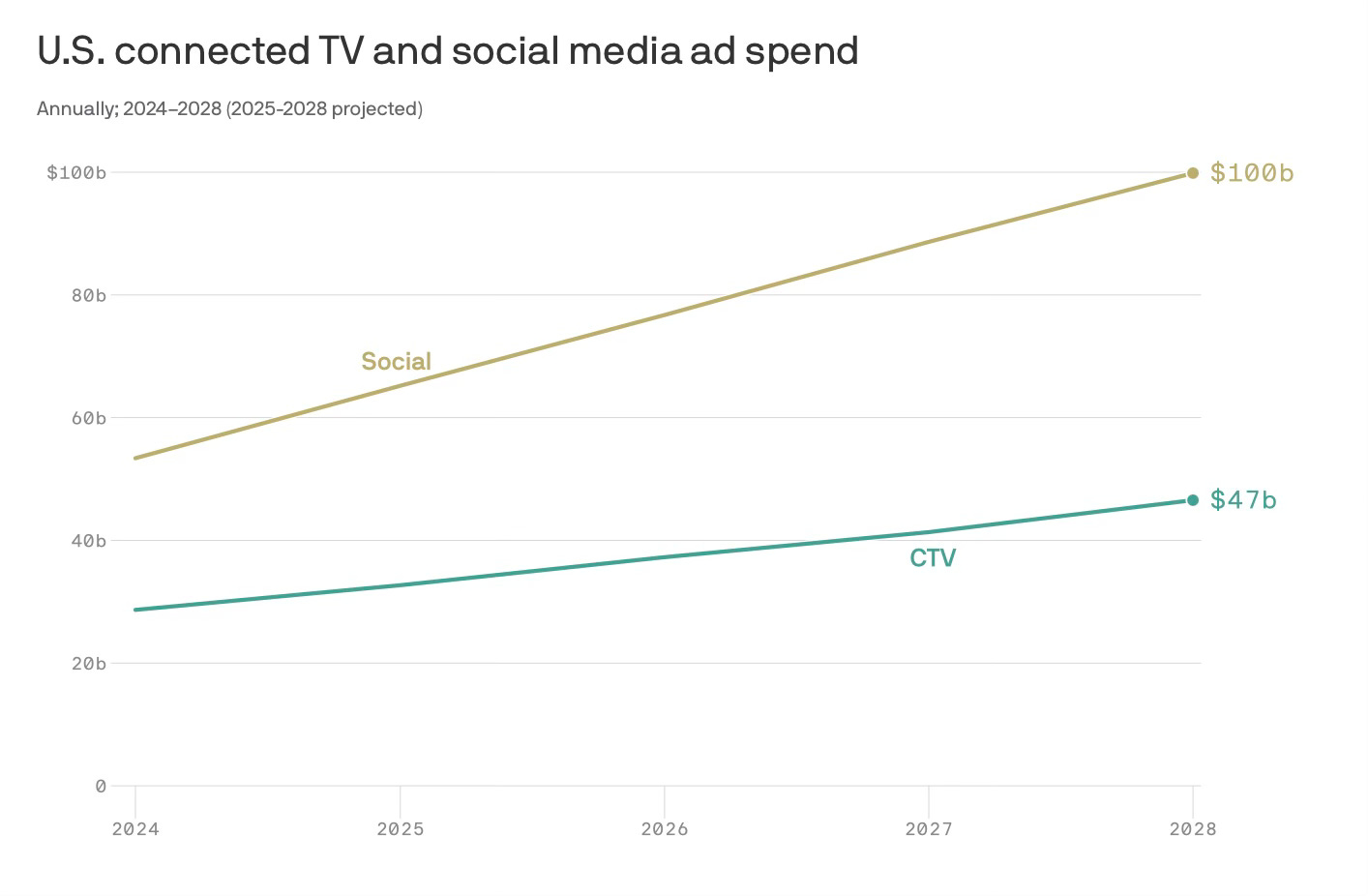

In December, Instagram announced it is putting Reels on CTV with an app initially coming to Fire TV devices in the US. TechCrunch confirmed the rollout to additional devices is planned for 2026.

Adam Mosseri at the Bloomberg Screentime conference: "If behavior [and] the consumption of these platforms is moving to TV, then we need to move to TV too," he said.

Pinterest is acquiring CTV ad company tvScientific to leverage its 600 million monthly active users into data that will allow tvScientific’s CTV advertising clients to track sales outcomes and shopping conversions.

The pattern is clear. Social platforms see YouTube dominating the TV screen and want a piece of that action. Expect more CTV apps from social players in 2026, along with the measurement and attribution infrastructure to prove ROI to advertisers.

#6. The reign of boring (but relevant) AI use cases

In December, Disney and OpenAI announced a major partnership. Disney bought an equity stake for $1 billion and licensed Sora for short form video on Disney+. But the real AI story in Media and Entertainment is quieter and less flashy. According to Adobe Business, 56% of M&E companies deliver personalized content recommendations and 57% generate personalized ad copy for audience segments. That is not sexy and is not going to make the front page but it drives real business value.

In 2026, the AI use cases that matter will be the boring ones: metadata tagging, content localization, ad targeting, customer service automation, recommendation engines. The companies that chase AI headlines will burn money. The companies that apply AI to operational problems will gain a competitive edge.

#7. The Microdrama hype will die down

The numbers look incredible on the surface. According to Variety’s deep dive on the global microdrama boom, revenues in China surged from $500 million in 2021 to $7 billion in 2024, projected to reach $16.2 billion by 2030. Outside China, the global vertical drama market generated $1.4 billion in 2024 and is forecast to reach $9.5 billion by 2030. DramaBox logged 44 million monthly active users in H1 2025.

But look closer. Data shows overseas revenue growth declined 68% in Q2 2025, largely due to slowing user acquisition. The number of apps targeting international markets quadrupled in one year, from 41 to 237. More apps, same audience, rising costs.

The unit economics are brutal. ReelShort generated $400 million in 2024 but remains unprofitable due to heavy marketing spend. According to Media Partners Asia, DramaBox posted $323 million and just $10 million in profit. Customer acquisition in North America is estimated to cost $15 per user.

Content fatigue compounds the problem. The World of Chinese reports that audiences grew “largely desensitised and tired of formulaic reversals” by 2024. The Micro-Series Certified Alliance launched explicitly to counter “global fatigue caused by repetitive content.”

The demand is real but how it’s being met isn’t. Who needs a dozen apps and a pay as you go model? Expect consolidation, IP lawsuits (already underway) and a shakeout among 200+ apps fighting for scraps. For most players, that math is already upside down.

#8. M&A wave hits the Creator world

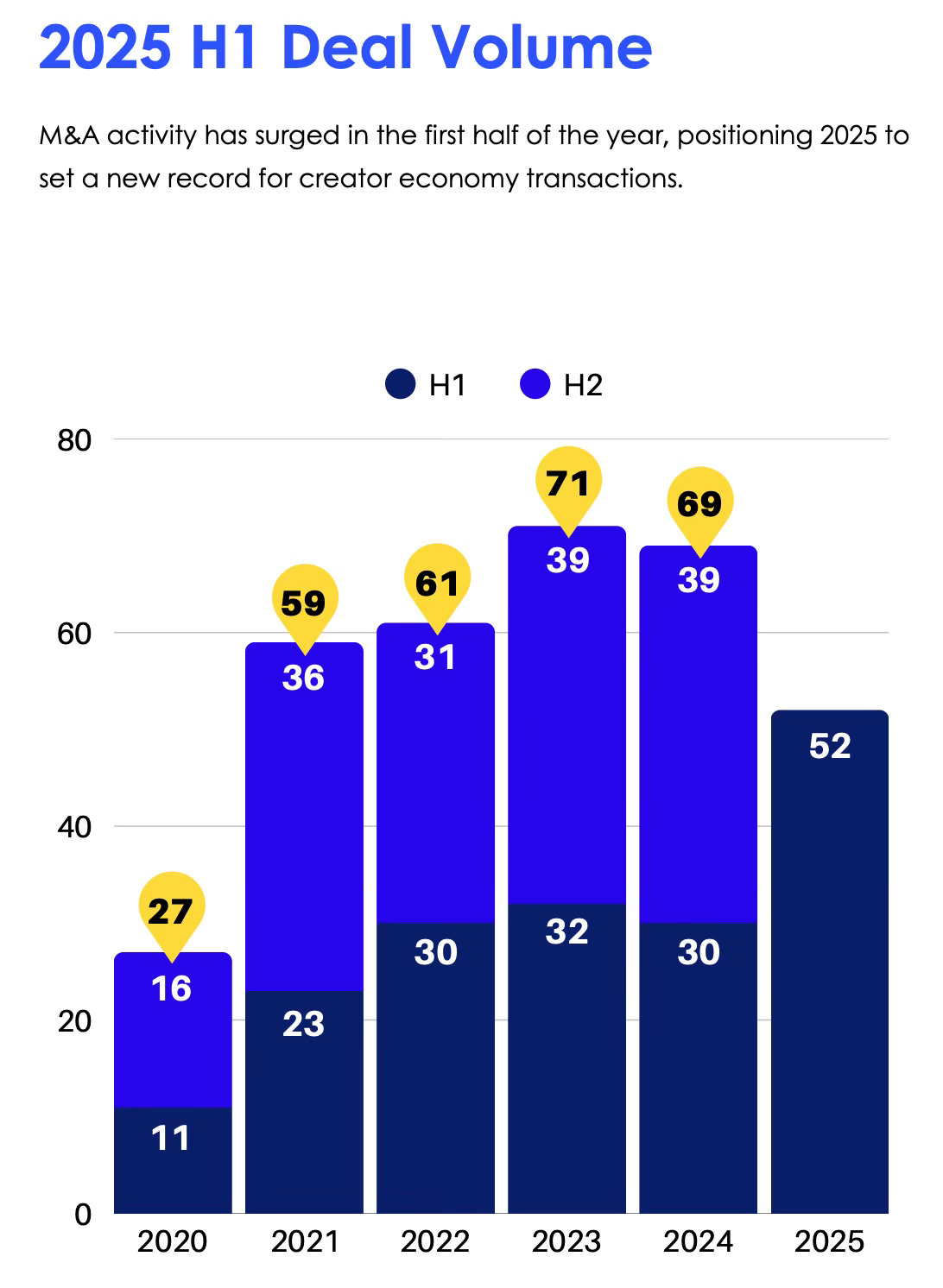

In the creator landscape, the first half of 2025 saw M&A deals up 73% year over year, with deal volume increasing to 52 deals from 30 in H1 2024 according to boutique M&A advisory firm, Quartermast Advisors.

Creator businesses that once seemed too small or too personality-dependent to acquire are now acquisition targets.

As traditional media companies struggle to reach younger audiences, buying creators becomes a shortcut. As creator businesses mature and seek exits, selling becomes attractive. The deal flow will accelerate in 2026.

#9. A new generation of CEOs reshapes European Media

Leadership transitions rarely arrive one at a time. Priya Dogra was named CEO of Channel 4. In May 2026, Clement Schwebig will step up at RTL, returning from Warner Bros. Discovery where he ran Western Europe and Africa. These are not caretaker appointments, they signal a generational handoff.

Expect more of the same in 2026. The executives who built their careers during the linear golden age are making way for leaders who came up through digital, streaming, and platform businesses. That shift in perspective will ripple through strategy, content investment and partnership decisions across the continent.

Keep your eyes on who fills the next round of top jobs (BBC, Channel 5 are still up for grabs). The names will tell you where the boards think the industry should be going.

#10. A painful year for Commercial and Public Service Media

Let me be direct: 2026 will hurt.

→ European commercial broadcasters felt the squeeze in 2025. RTL Group’s TV advertising revenue fell 7.4% in the 1st 9 months of the year, forcing a 16.7% cut to EBITA guidance. ITV’s total advertising revenue dropped 5%, with Q4 forecast down 9%. TF1 saw ad revenue decline 2.2%, blaming political & financial instability. ProSiebenSat.1’s entertainment advertising fell 7%, extending a cumulative 20% decline in DACH ad revenues since 2018. Digital grew double digits at each company, but not fast enough to offset linear erosion.

In the UK, Guideline data shows linear TV ad spend fell 12% in 2025, with a further 2.6% decline forecasted for 2026 (which could have been worse without the upcoming Winter Olympics and the FIFA World Cup).

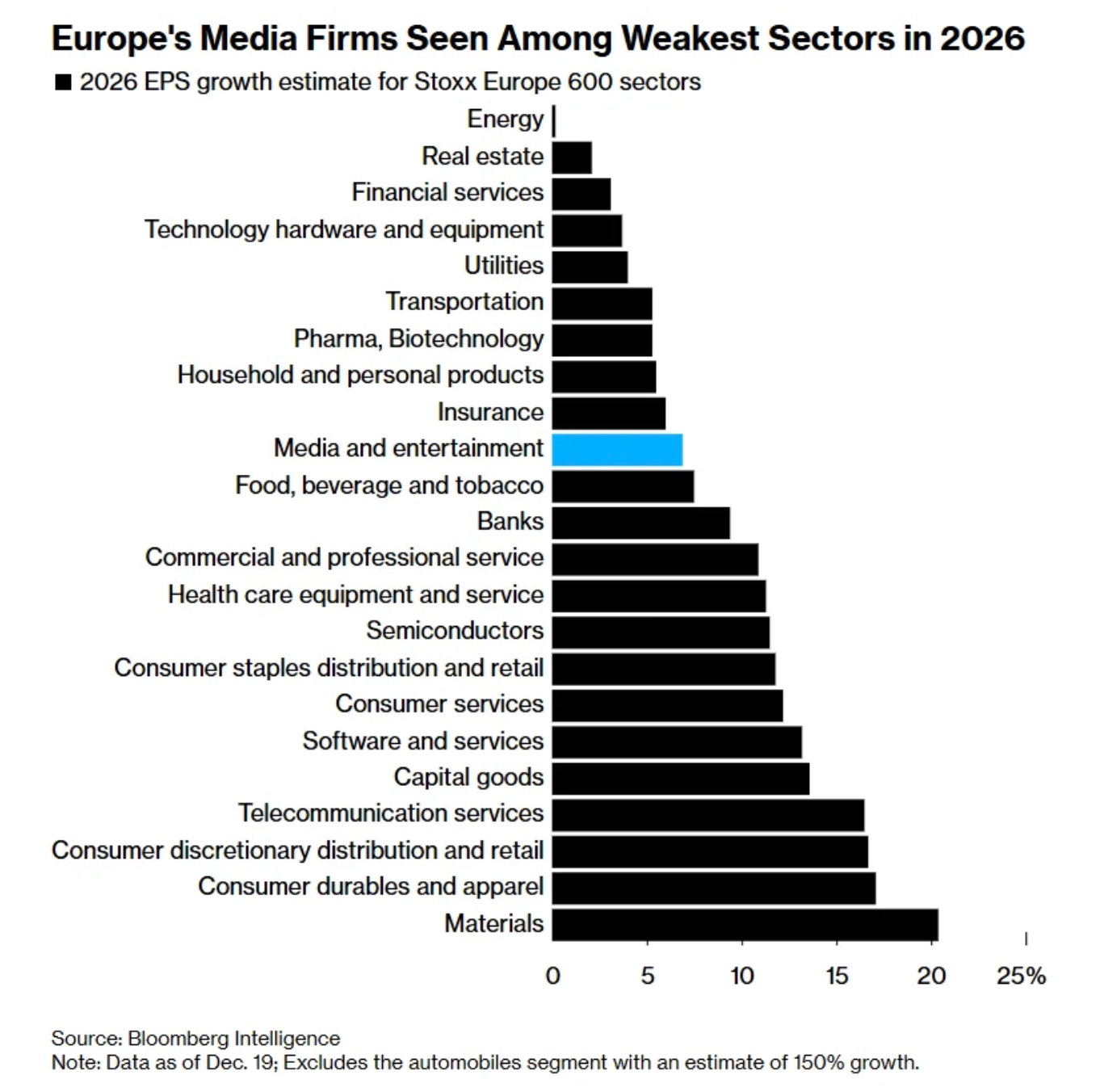

Bloomberg Intelligence forecasts European media companies will achieve profit growth of just 6.9%, well below the 10% expected for the broader Stoxx Europe 600.

→ Public service media faces its own storm, both on political and financial fronts.

In Germany, ARD and ZDF have seen the licensee fee frozen until 2027, squeezing budgets below inflation (a 1.53% increase for 2027 was announced on Dec. 10th). Same thing in Austria until 2029 pushing ORF to launch a 325M€ savings program by 2026, with another 320M€ needed in cuts (programming + personnel) by 2029. Switzerland’s SRG SSR is already cutting CHF 270M (17% of its budget) by 2029, yet faces a March 2026 referendum that could slash the license fee from CHF 335 to CHF 200, with polls showing 53% in favor.

The UK’s BBC Charter renewal debate is underway with no clarity on how the license fee model will evolve (status quo, advertising or a subscription fee model are being contemplated). The BBC’s real term funding has decreased by 1B£ per year compared to 2010.

France Télévisions expects a 65.2M€ decline in funding and plans a saving of 140M€, while its CEO, Delphine Ernotte Cunci, is facing multiple attacks as part of an ongoing parliamentary investigation on the neutrality, functioning and funding of the public group. If you want a masterclass in keeping it calm when fakes news and disgraceful insinuations are being thrown at you, have a listen at her audition here.

European Public Service Media will have to do more with less.

Across commercial and public organisations, European broadcasters surprised me more than once in 2025 (Netflix x TF1; FTV x Amazon; RTL x Sky; Sky x ITV). They are already working to transform their businesses. We’ll see what these partnerships & deals actually do to their businesses but you can’t accuse them of inertia. I have little doubt about their ability to dig deep to power through 2026 and I’ll be cheering them from the sidelines.

That’s it for today but before you go tell me: What did I miss? What do you see differently? Hit reply. I read every response.

Here is to a year of interesting problems and smart solutions 🥂

Interesting takes, as always. Thanks for putting it out there.

I would also add that, as AI becomes more prevalent in content creation, many people will reject it in some way. If X offered an AI content blocker, I would enable it immediately. The industry will continue experimenting with methods to better satisfy its users in this regard.

Cold Weather, VERY Hot Takes!! 👏👏👏