Inside ITV 2024 FY Results

I dug into their earnings report so you don't have to

You ask, I deliver.

The Streaming Made Easy Earnings Hub now includes UK Broadcaster ITV. This week, we’re indeed going through ITV’s FY 2024 performance, with a focus on the Studios and M&E segments, and finally a quick look at what 2025 has in store for them.

P.S.1: I’ve prepared a deck you can grab to have ITV’s results handy.

P.S.2: Don’t forget to vote for the next European company to join the Earnings Hub.

Today at a glance:

Financial Results

Broadcast & Streaming Focus

ITV Studios Focus

2025 Guidance

Financial Results

Income Statement Highlights

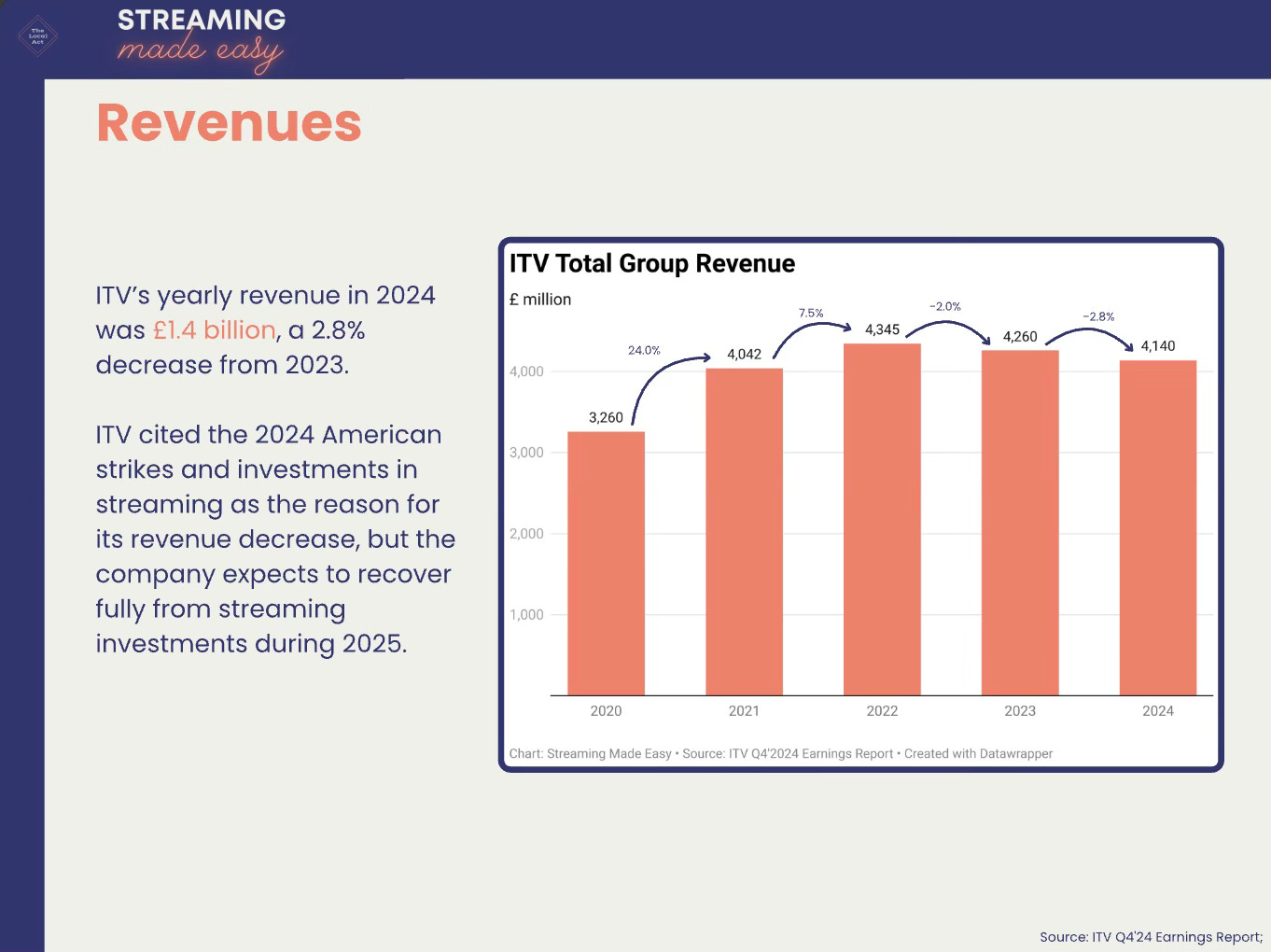

→ Total revenue: £4.14bn (-2.8% YoY)

ITV Studios: £2.04bn (–6% YoY).

M&E: £2.10bn (+1% YoY).

Advertising revenue up +2.4% (£1.82 billion). This rise was driven mainly by digital ad revenue (+14.8% YoY) who now makes 26% of all advertising revenues.

Other M&E elements offset that +2% advertising gain.

Subscription revenue fell 19% (from £59 million to £48 million).

SDN (transmission and infrastructure of DTT) was down 10% (from £48 million to £43 million).

Partnerships & other slid 7% (from £205 million to £191 million).

→ Adjusted EBITA: £542m (+11% YoY).

ITV Studios: £299m (+5% YoY).

M&E: £250m (+22% YoY).

💬 The numbers show that despite a 2.8% decline in total revenue to £4.14 billion, ITV’s digital advertising growth, disciplined cost management, and margin improvements in both Studios and M&E pushed adjusted EBITA up 11% year-on-year to £542 million.