European Telcos enter their CTV era

As Pay TV falters, Sky, Magenta TV & Telefónica push onto CTVs to stay first click.

This is a reader-supported publication. If you like what I do, help me keep doing it by upgrading to Streaming Made Easy Premium, we got a free month giveaway code right here 🫶

European Telecom Operators couldn’t care less about CTV 5 years ago. I know this first hand because I tried to get them to launch their apps on a CTV platform. At the time, all signals were green, they didn’t need to be on CTV.

Fast forward to today, they have started to prepare themselves for a boxless world, one where their customer relationship becomes device agnostic. Building their brands on CTV is their chance to keep the customer relationship and control the first click but entering the CTV arena means partnering with the very platforms they also compete against today. So let’s unpack the partnerships, risks and early proof points as Telcos enter their CTV era.

At a glance:

The market context

The Telco strategies at play

The stakes

The open question: Will Telcos carve out space on CTV or get squeezed out?

Mentioned in this edition: Deutsche Telekom (MagentaTV), Telefónica (Movistar Plus), Sky (NOW, Sky Glass), Hisense, Vidaa, Orange, SFR, Samsung, LG, Android TV, Apple TV, Fire TV (Amazon), Roku, Titan OS, Virgin Media, Vodafone.

The market context

Multiple indicators in 2025 show Pay TV is under pressure across Western Europe:

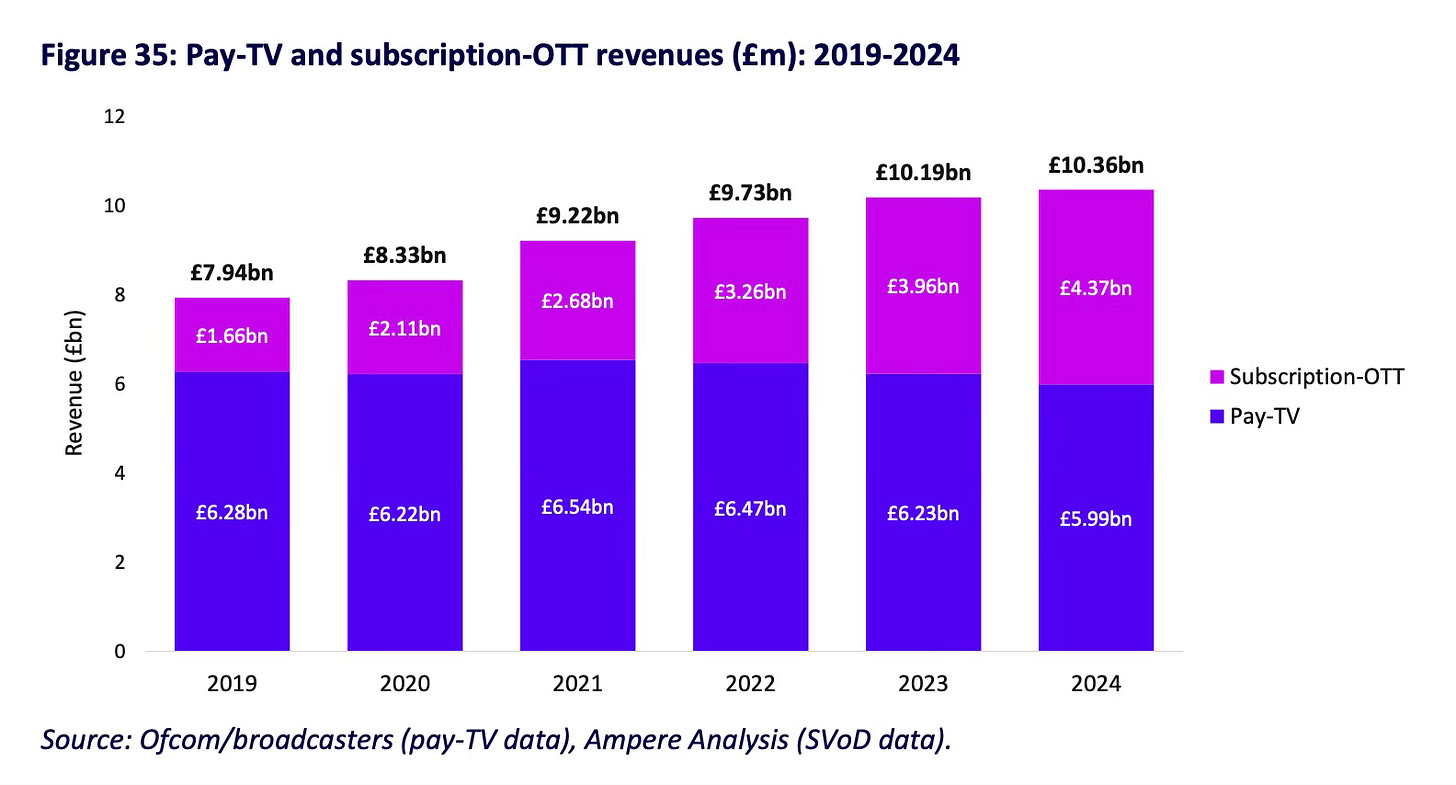

In the UK, Pay TV penetration fell from 54% of households in 2016 to 37% by end-2024, with revenue dipping below £6 bn for the first time in a decade according to OFCOM’s Media Nations Report.

In France, Futuresource Consulting forecasts Pay-TV’s revenue share to decline to 37% by 2029 (vs 45% in 2024).

Even Deutsche Telekom, the European mastodon with its 115.8B€ of revenues, experiences slower growth in Germany this year (with 37K net TV subscriber additions in Q1 2025 vs 73K a year prior; then again 23K in Q2 2025 vs 114K).

Spain and Italy’s revenue mix sees Pay TV representing 47% and 44% respectively.

According to Dataxis:

“With 187M households equipped with a Smart TV, smart TV penetration has overtaken Pay TV subscriptions in Europe (excluding Russia) since Q4 2024. (…) Between 2020 and 2024, smart TV adoption grew at an average annual rate of around +10%, while pay TV subscriptions rose by only 1% over the entire period and began to decline in Q4 2024 and Q1 2025 (-1% and -0.15%, respectively).”

Bundled deals that integrate SVOD services into Pay-TV packages are helping retain customers but Telcos need to be where eyeballs are and it’s increasingly on CTV.